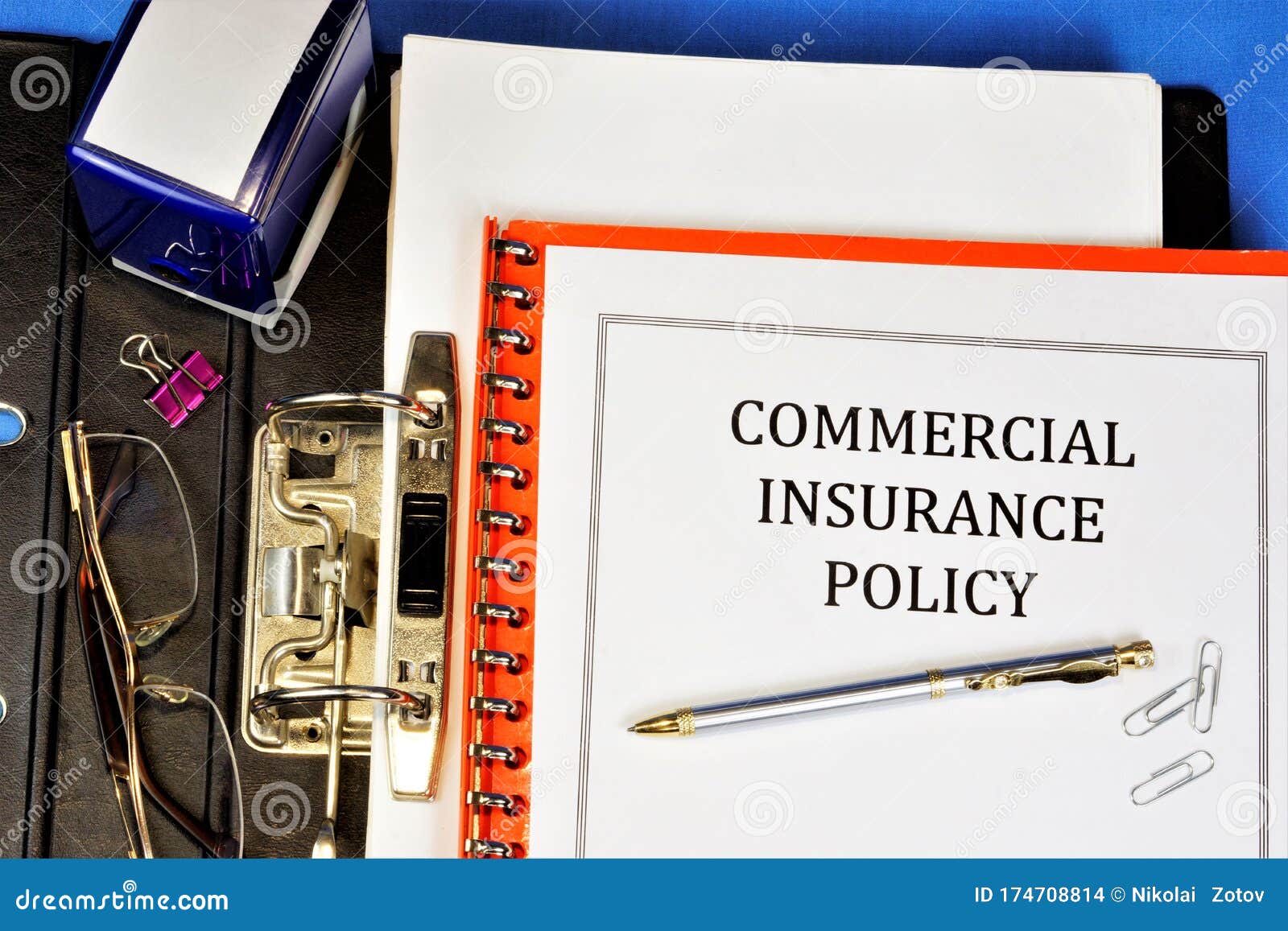

Running a business involves a great deal of risk, and protecting it should be at the top of every entrepreneur’s priority list. That’s where business insurance comes in. With a range of policies designed to safeguard your business, it offers peace of mind and financial security, should the unexpected happen. From liability claims to property damage, business insurance encompasses a wide variety of coverage options tailored to meet the unique needs of your company. In this article, we will explore some key aspects of business insurance, including Workers Compensation Insurance, D&O Insurance, and more, to give you a comprehensive understanding of how this essential protection can benefit your organization. So buckle up and get ready to delve into the world of business insurance, where knowledge truly is power.

Workers Compensation Insurance

Workers Compensation Insurance is a crucial component of any comprehensive business insurance plan. It is specifically designed to provide financial protection for both employers and employees in the event of work-related injuries or illnesses. This type of insurance helps cover the medical expenses, lost wages, and rehabilitation costs incurred by employees, ensuring they receive the necessary support to recover and return to work.

By having Workers Compensation Insurance in place, employers can be confident that their employees are protected and their business is shielded from potential lawsuits related to workplace accidents. This insurance is typically mandatory, and laws regarding coverage requirements may vary based on the jurisdiction and type of business.

One of the main benefits of Workers Compensation Insurance is that it provides a no-fault system, meaning that employees can receive benefits regardless of who was at fault for the injury or illness. This helps streamline the claims process and avoids lengthy legal battles, enabling employees to receive prompt medical treatment and financial assistance.

In addition to providing financial protection for employees, Workers Compensation Insurance also offers benefits for employers. By having this coverage, employers are protected from lawsuits brought by employees seeking compensation for work-related injuries. This can help mitigate the financial impact of litigation expenses and potential damages, ensuring the continuity and stability of the business.

Overall, Workers Compensation Insurance is essential for businesses of all sizes and industries. It not only provides the necessary support for injured or ill employees but also safeguards the interests of employers. Having this coverage in place ensures that businesses can focus on their operations with peace of mind, knowing that they have taken proactive steps to protect their employees and their organization.

Business Insurance

Business insurance is a crucial aspect of protecting your company and its assets. It provides coverage for various risks and liabilities that your business might face. Depending on your specific needs, there are different types of business insurance policies available. Two common types include workers’ compensation insurance and directors and officers (D&O) insurance.

Apartment Owner Insurance in California

Workers’ compensation insurance ensures that your employees are protected in case of work-related injuries or illnesses. It provides financial assistance for medical expenses, lost wages, and rehabilitation services. By having workers’ compensation insurance, you not only meet legal requirements but also demonstrate your commitment to the well-being of your workforce.

D&O insurance, on the other hand, is essential for companies with directors and officers. It protects these individuals against legal claims made by employees, investors, or other stakeholders. D&O insurance coverage includes defense costs, settlements, and judgments. Having this insurance in place helps attract experienced individuals to join your company’s leadership team.

Remember, business insurance is not a one-size-fits-all solution. It’s crucial to assess your specific risks and consult with insurance professionals to tailor a plan that suits your business needs. By carefully selecting the right insurance coverage, you can safeguard your company’s financial stability and mitigate potential risks.

D&O Insurance

Directors and Officers Insurance, commonly known as D&O Insurance, is a crucial component of business insurance. This type of coverage is specifically designed to protect the directors and officers of a company from personal liability for their actions and decisions made in the course of their duties.

D&O Insurance provides financial protection for directors and officers facing lawsuits, whether they are brought by employees, shareholders, or other stakeholders. It helps cover legal expenses, settlements, and judgments, ensuring that personal assets are not at risk in case of claims related to alleged wrongful acts or negligence.

Having D&O Insurance in place is essential for businesses as it gives directors and officers the peace of mind to make tough decisions without the fear of personal financial ruin. This coverage not only attracts talented individuals to assume leadership positions within organizations but also safeguards their personal assets, making it an important risk management tool.

In addition, D&O Insurance can also extend coverage to the company itself, providing protection in situations where the company may be legally obligated to indemnify its directors and officers. This inclusion further strengthens the overall protection for both the individuals and the organization itself.

In conclusion, D&O Insurance plays a vital role in today’s business landscape. By offering financial protection to directors and officers, it promotes good corporate governance and enables these key individuals to make informed decisions for the betterment of the company. With the potential risks and legal challenges that organizations face, having D&O Insurance is a proactive step towards protecting both personal and corporate interests.