Commercial insurance is a critical aspect of running a business, offering protection and peace of mind in a world filled with uncertainty. Whether you’re a small start-up or a large corporation, understanding the ins and outs of commercial insurance is essential for safeguarding your business’s financial stability. In this comprehensive guide, we will delve into the intricacies of commercial insurance, discussing key aspects such as general liability insurance, workers’ compensation insurance, and cyber liability insurance. By the end, you’ll have a solid foundation to navigate the complex realm of commercial insurance and make informed decisions that align with your company’s needs. So, let’s dive in and explore the world of commercial insurance together.

Understanding Commercial Insurance

Commercial insurance is a vital aspect of protecting your business from unexpected events and potential financial harm. It provides coverage for various risks and liabilities that may arise in the course of running a business. From general liability insurance to workers’ compensation insurance and cyber liability insurance, understanding the different types of commercial insurance can help safeguard your business and its assets.

General liability insurance acts as a safety net, shielding businesses from third-party claims arising from bodily injury or property damage that occur on their premises. This coverage also extends to legal expenses in case of lawsuits or claims. With general liability insurance, businesses can have peace of mind knowing that they are protected against the uncertainties that may arise from day-to-day operations.

Workers’ compensation insurance is designed to provide financial protection to both employees and employers in the event of work-related injuries or illnesses. This insurance coverage ensures that employees are adequately compensated for medical expenses, lost wages, and rehabilitation, while also protecting businesses from potential lawsuits related to workplace injuries. It is a crucial component of creating a safe and secure working environment.

The rapid growth of technology and the increasing dependence on digital platforms has led to the need for cyber liability insurance. This type of coverage protects businesses from the financial burden that can arise from cyberattacks, data breaches, or other incidents impacting digital information. Cyber liability insurance assists in covering costs associated with data recovery, legal fees, and potential compensation to affected parties. In our digital age, having this insurance can safeguard the reputation, financial stability, and continuity of your business.

By familiarizing yourself with the different types of commercial insurance, such as general liability, workers’ compensation, and cyber liability insurance, you can navigate the world of commercial insurance effectively. Understanding the coverage and benefits that each type of insurance offers will enable you to make informed decisions to protect your business from potential risks and liabilities. Ensure that you explore the options available and work closely with insurance professionals to tailor a commercial insurance package that suits your business needs.

Types of Commercial Insurance Coverage

General Liability Insurance:

General liability insurance is a crucial form of coverage for business owners. It protects your company from financial loss in case of third-party claims relating to property damage, bodily injury, or personal injury. Whether it’s a slip and fall accident on your premises or damage caused by your products or services, general liability insurance provides peace of mind and safeguards your business from potentially devastating lawsuits.

Workers’ Compensation Insurance:![]()

Insurance for general contractors

When it comes to protecting your employees and your business, workers’ compensation insurance is a necessity. This type of coverage is designed to provide medical benefits and wage replacement to employees who suffer work-related injuries or illnesses. By offering financial support to your employees during their recovery, workers’ compensation insurance not only helps mitigate the impact of workplace accidents but also promotes a safer and more secure work environment for your staff.

Cyber Liability Insurance:

As our reliance on technology grows, so does the need for cyber liability insurance. This specialized coverage protects businesses from the financial repercussions of data breaches, cyberattacks, and other forms of digital threats. Cyber liability insurance not only provides financial assistance for the costs associated with data recovery and legal claims but also offers resources to help mitigate reputational damage and protect sensitive customer information. With the increasing frequency of cybercrimes, having this type of insurance coverage is essential for businesses of all sizes.

Remember to consult with an experienced insurance professional who can guide you in selecting the appropriate commercial insurance coverage based on your specific business needs.

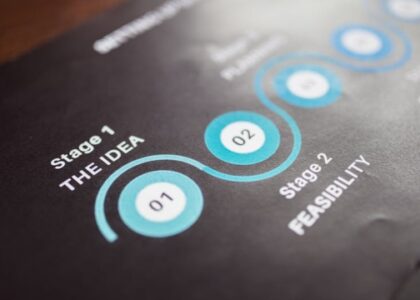

Essential Considerations for Choosing Commercial Insurance

-

Coverage Needs:

When it comes to choosing commercial insurance, the first and foremost consideration should be your coverage needs. Think about the nature of your business and the potential risks it faces. Do you require general liability insurance to protect against third-party injury claims? Or is workers’ compensation insurance more important to ensure the well-being of your employees? Additionally, if your business operates in the digital realm, cyber liability insurance might be essential to safeguard against data breaches and other cyber threats. By understanding your coverage needs, you can ensure that the commercial insurance you choose provides comprehensive protection for your business. -

Financial Stability of Insurer:

Another crucial aspect to consider while selecting commercial insurance is the financial stability of the insurer. You want to partner with an insurance company that can meet its financial obligations in the event of a claim. Research the insurer’s financial ratings and assess their track record. A financially stable insurer inspires confidence and provides assurance that they can handle your claims effectively. It is wise to delve into the financial health of the insurance company before finalizing your decision. -

Customizability and Flexibility:

Flexibility is vital when it comes to commercial insurance. Every business has unique requirements, and it is essential to find an insurer that offers customizable policies. Look for insurers who understand the specific risks associated with your industry and can tailor coverage accordingly. Furthermore, consider insurance companies that allow flexibility in modifying your policy as your business evolves. The ability to adjust coverage as your needs change ensures that your commercial insurance will continue to meet your requirements, providing peace of mind in an ever-changing business landscape.

Remember, carefully evaluating your coverage needs, choosing a financially stable insurer, and prioritizing customizability and flexibility will help you navigate the world of commercial insurance successfully. By taking these essential considerations into account, you can ensure that you select the right commercial insurance policy to protect your business.