Welcome to our exclusive guide where we unravel the enigmatic world of Workers Compensation Insurance. Whether you’re a business owner or an employee, this comprehensive article aims to shed light on this vital aspect of commercial insurance in California. With a specific focus on industries such as restaurants and commercial auto, we’ll provide you with the knowledge and understanding necessary to navigate through the complexities of Workers Compensation Insurance. So, without further ado, let’s embark on this informative journey and unlock the mysteries that surround this essential form of insurance coverage.

Understanding Workers Compensation Insurance

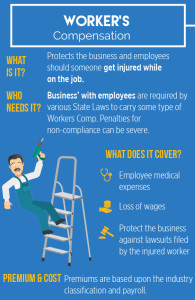

Workers Compensation Insurance is a vital form of coverage for businesses operating in California. It provides protection for both employers and employees in the event of work-related injuries or illnesses. This insurance is mandatory for most businesses in California, ensuring that workers are adequately compensated and protected.

Workers Compensation Insurance in California is designed to provide benefits to employees who suffer injuries or illnesses arising from their employment. It covers medical expenses, lost wages, and rehabilitation costs incurred due to work-related incidents. This insurance also protects employers from potential lawsuits from injured employees, as it generally replaces the right to sue the employer in exchange for the benefits provided.

In industries like the restaurant and hospitality sector, where work-related injuries can be more common, having Workers Compensation Insurance is crucial. California requires businesses operating in the state, including restaurants, to carry Workers Compensation Insurance coverage for their employees. It ensures that employees can receive timely medical treatment and compensation for lost wages, and employers can avoid legal issues and potentially costly lawsuits.

With commercial insurance California coverage, including Workers Compensation Insurance, businesses can meet their legal obligations while safeguarding their financial stability. It is important to understand the specifics of the coverage and the requirements for different industries, such as the restaurant and hospitality sector, to ensure compliance and adequate protection.

Remember, Workers Compensation Insurance is an essential aspect of operating a business in California and should not be overlooked. By understanding this insurance and fulfilling your obligations, both as an employer and an employee, you can help create a safe and secure work environment for everyone involved.

Importance of Workers Compensation for Businesses

Workers compensation insurance is an essential safeguard for businesses, offering crucial protection against potential workplace accidents and injuries. As an employer, it is your responsibility to prioritize the safety and well-being of your employees. Securing workers compensation insurance is not only a legal requirement in most states, including California but is also a vital part of your overall risk management strategy.

By providing workers compensation coverage, you demonstrate your commitment to your employees’ welfare and ensure that they are adequately protected in case of work-related mishaps. Accidents can happen unexpectedly, even in the safest work environments. Having workers compensation coverage in place provides financial support to injured employees, covering medical expenses, lost wages, and rehabilitation costs. This insurance not only benefits your employees but also shields your business from potential lawsuits arising from workplace injuries.

In certain industries, such as the restaurant and hospitality sector, the risk of workplace injuries may be higher due to the nature of the work involved. Restaurants, for example, have specific hazards related to food preparation, handling machinery, and potential slips and falls. Commercial insurance coverage in California, tailored for restaurant owners, often includes workers compensation insurance as a critical component. Having the right insurance coverage custom-tailored to your business needs ensures that you can effectively manage and mitigate risks.

Additionally, for businesses that rely on commercial vehicles for daily operations, having commercial auto insurance coverage is essential. Commercial auto insurance in California provides protection against accidents involving business-owned vehicles, ensuring that both your employees and vehicles are protected. This coverage helps with medical expenses and property damage expenses resulting from accidents, making it an important aspect of your overall risk management strategy.

In conclusion, workers compensation insurance, along with commercial insurance and commercial auto insurance, play a vital role in safeguarding your business and employees. These insurance policies protect your business from potential financial liabilities and demonstrate your commitment to creating a safe work environment. By investing in the appropriate insurance coverage, tailored to your business’s unique needs, you ensure the continuity and long-term success of your enterprise.

Tips for Navigating Workers Compensation Insurance in California

-

Understand the Basics:

Workers compensation insurance is a vital protection for both employers and employees in California. It provides coverage for medical expenses, lost wages, and rehabilitation services in case a worker is injured or becomes ill due to their job. It is crucial to familiarize yourself with the key aspects of workers compensation insurance, such as how claims are filed, what types of injuries are eligible for coverage, and the role of insurance carriers and employers in the process. -

Choose the Right Insurance Provider:

Selecting the right insurance provider is essential for ensuring a smooth experience with workers compensation insurance. Consider working with an insurer who specializes in commercial insurance in California and has expertise in workers compensation. Look for a company that understands the unique needs of your industry, such as restaurant insurance in California. They will be better equipped to guide you through the complexities of workers compensation and ensure you receive appropriate coverage at a competitive price. -

Maintain a Safe Working Environment:

Prevention is key when it comes to workers compensation insurance. By maintaining a safe working environment, you can minimize the risk of accidents and injuries, ultimately reducing your insurance costs. Implement thorough safety guidelines and provide training to employees on workplace hazards and best practices. Regularly assess and address any potential safety concerns in your business to demonstrate your commitment to employee well-being and mitigate the likelihood of incidents.

Commercial auto insurance California

Remember, navigating workers compensation insurance in California can be complex, but by understanding the basics, choosing the right insurance provider, and prioritizing workplace safety, you can protect your employees and your business effectively.