The modern era has ushered in a wave of groundbreaking advancements, setting the stage for an extraordinary transformation in the banking industry. As technology rapidly evolves, it is rewriting the rules of banking, redefining how financial institutions operate and interact with their customers. Banking automation, in particular, stands at the forefront of this revolution, empowering banks to streamline their processes, enhance efficiency, and offer unparalleled convenience to their account holders.

At its core, banking automation refers to the integration of digital systems and advanced technologies into the traditional banking infrastructure. From transaction processing to customer service, automation has become a vital tool for banks to ensure seamless operations and exceptional user experiences. This shift towards automation is not only driven by the demand for greater agility but also by the unstoppable progression of technology itself. With solutions like artificial intelligence, machine learning, and robotic process automation, banks are now equipped with a suite of powerful tools to enhance their operational efficiency, reduce costs, and propel growth.

As the banking landscape becomes increasingly digital, it is imperative for financial institutions to adapt and embrace automation to stay competitive. This comprehensive guide will delve into the world of banking automation, exploring its various applications, benefits, and the key considerations to keep in mind when implementing such solutions. Join us as we embark on this exciting journey to uncover how banking automation is reshaping the industry, revolutionizing the way we bank, and paving the way for a future where innovation knows no bounds.

Benefits of Banking Automation

Banking automation has revolutionized the way financial institutions operate, offering numerous benefits that improve efficiency, customer service, and overall productivity.

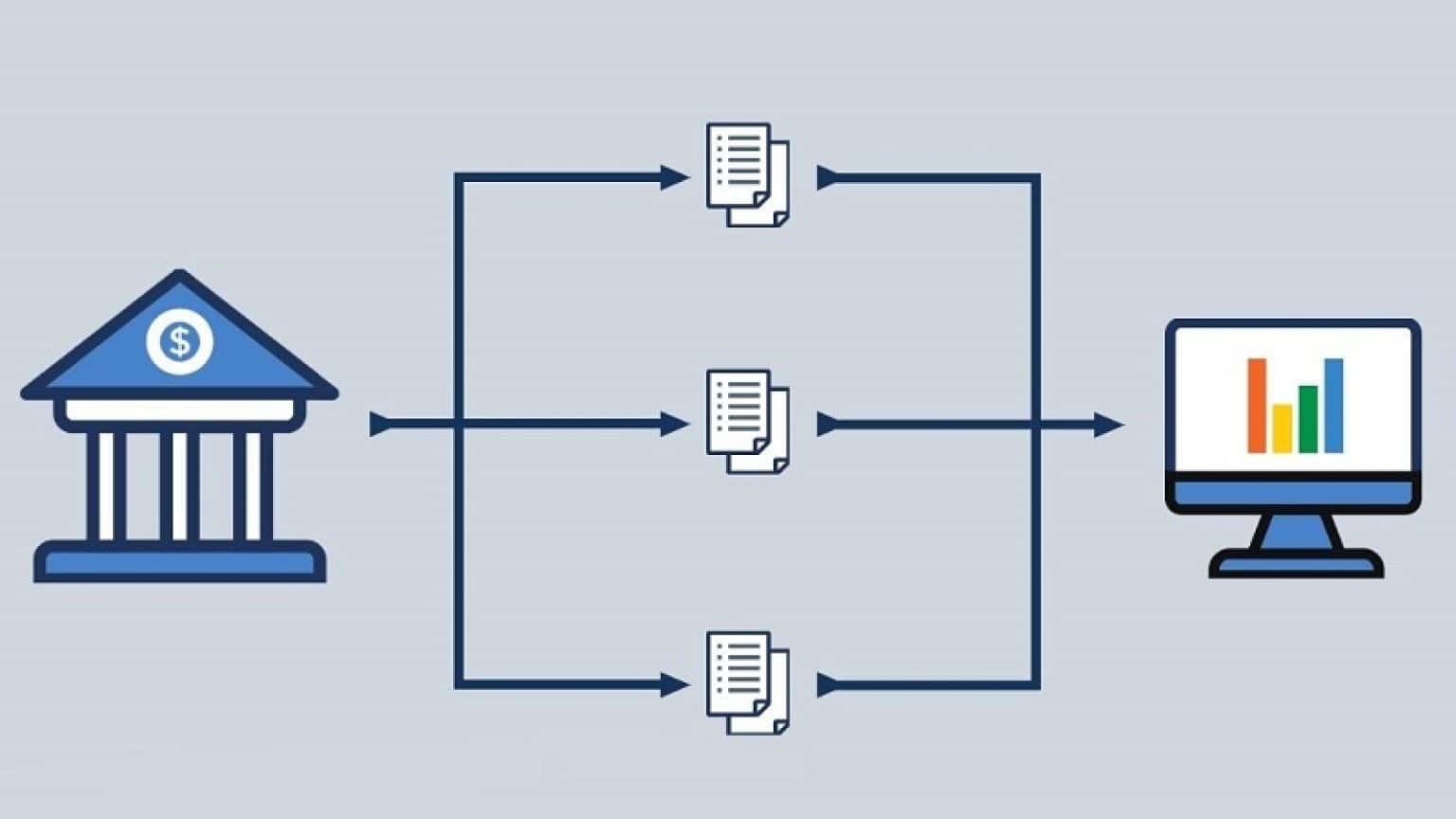

Firstly, one key advantage of banking automation is the enhanced speed and accuracy it brings to everyday banking tasks. By automating manual processes such as data entry, transaction processing, and report generation, banks can streamline their operations and significantly reduce the margin for error. This not only saves valuable time but also ensures that customer information and financial transactions are handled with utmost precision.

Secondly, automation in banking enables round-the-clock accessibility for customers. With automated systems in place, individuals can perform essential transactions, access account information, or even apply for loans at any time of the day or night, from the comfort of their own homes. This convenient self-service option empowers customers and eliminates the need for them to visit physical branches, reducing wait times and enhancing overall customer satisfaction.

Lastly, banking automation solutions provide robust security measures to safeguard against fraud and unauthorized access. Advanced encryption algorithms and multi-factor authentication techniques strengthen data protection, making it significantly more challenging for malicious actors to compromise sensitive financial information. By leveraging automation, banks can establish trust and build a secure environment that caters to the needs of their tech-savvy customers.

In conclusion, banking automation has proven to be a game-changer in the financial industry, bringing numerous benefits that enhance speed, accuracy, accessibility, and security. By embracing automation solutions, banks can not only optimize their internal processes but also cater to the evolving needs and expectations of their customers in an increasingly digital world.

2. Key Features of Banking Automation Solutions

In the quest for innovation and efficiency, banking automation has emerged as a game-changer in the financial industry. With the aid of advanced technologies, this revolution in banking is reshaping traditional processes and propelling the industry into the future. Harnessing the power of automation, banks are able to streamline their operations, enhance customer experiences, and drive productivity. Here are some key features of banking automation solutions that are making waves in the industry.

-

Streamlined Transaction Processing: One of the primary benefits of banking automation is the ability to streamline transaction processing. Through advanced automation solutions, banks can reduce manual work, eliminate errors, and accelerate transaction times. With automated systems handling tasks like fund transfers, bill payments, and account reconciliations, the risk of human error is significantly minimized, leading to more accurate and efficient operations.

-

Enhanced Customer Engagement: Automation in banking allows for personalized and seamless interactions with customers. Through innovative solutions like chatbots and virtual assistants, banks can provide round-the-clock support and instant responses to customer queries. This not only improves customer satisfaction but also lessens the load on human call center agents, enabling them to focus on more complex customer issues. With automation, customers can access their account details, make inquiries, or even apply for loans anytime and anywhere, conveniently and hassle-free.

-

Robust Risk Management: Another significant aspect of banking automation solutions is the integration of robust risk management capabilities. By leveraging artificial intelligence and machine learning algorithms, banks can effectively detect and prevent fraud, unauthorized access, and suspicious activities in real-time. Automation enables banks to analyze large volumes of data and identify patterns or anomalies that might indicate fraudulent behavior. This preemptive approach to risk management helps protect both the financial institution and its customers, establishing a secure and trustworthy banking ecosystem.

In conclusion, banking automation solutions have become a catalyst for the digital transformation of the financial industry. By embracing automation, banks can unlock numerous benefits such as streamlined transaction processing, enhanced customer engagement, and robust risk management. As technology continues to evolve, the future of banking is undoubtedly intertwined with automation, offering countless opportunities for growth and innovation.

3. Implementation and Future of Banking Automation

The implementation of banking automation solutions has brought forth an era of remarkable innovation within the industry. With the integration of advanced technologies such as artificial intelligence, machine learning, and robotic process automation, banks have witnessed significant improvements in operational efficiency and customer service.

One of the key benefits of banking automation is the ability to streamline various processes, enabling faster and more accurate transactions. Manual tasks that are prone to error, such as data entry and reconciliation, are now automated, reducing human intervention and minimizing the risk of mistakes. This not only saves time but also enhances the overall accuracy of banking operations.

The future of banking automation holds even more promise. As technology continues to evolve, we can expect even greater advancements in the realm of banking automation. For instance, the implementation of chatbots and virtual assistants may further improve customer support and experience, providing real-time assistance and personalized solutions. Additionally, the integration of blockchain technology has the potential to revolutionize transaction security and transparency, enhancing trust and confidence in the banking system.

As banks embrace the digital revolution and prioritize automation, they are better positioned to meet the evolving needs of their customers. From online banking to mobile apps, these platforms have become more intuitive and user-friendly, empowering customers with greater control over their finances. Moreover, the automation of risk assessment and compliance processes enables banks to identify and respond to potential threats more efficiently, bolstering security measures and safeguarding against fraudulent activities.

In conclusion, the implementation of banking automation has paved the way for enhanced operational efficiency, improved customer service, and heightened security within the industry. Looking ahead, the future of banking automation holds immense potential as technological advancements continue to reshape the landscape. By embracing these advancements, banks can revolutionize the way they serve their customers and pave the way for a new era in banking.